Jump to page contents

What happens to Bitcoin’s price when it halves?

When a market is affected by any factors the price will tumble, and most investors are in turn taking a loss. So what is happening when Bitcoin is suffering a halving price effect?

With Bitcoin’s mining reward halving in the upcoming months, investors and analysts are curious to see how Bitcoin’s price is going to react to this instantaneous supply decrease. The mining process will become twice as expensive (in the sense that miners will only get half of their previously earned reward), which will affect miners of all sizes. In the two previous halving events, taking place in 2012 and 2016, we saw a steady price increase leading up and following the halving, followed by much larger and substantial gains within 1 year of the halving date. In the case of both the 2012 and 2016 halvings, within one year of each, we saw a 9336.36% and 288.60% respectively. So, how will the Bitcoin price change?

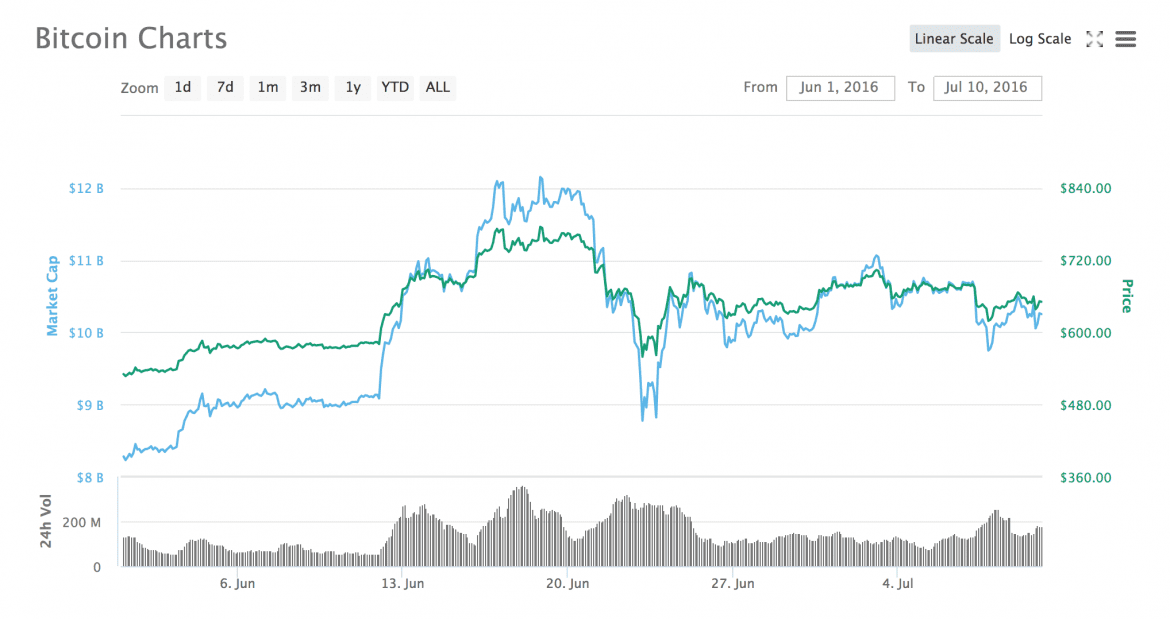

When considering these price changes, we also need to account for Bitcoin’s total market capitalization. In 2012 and 2016, Bitcoin had a market cap of approximately $1 billion and $10 billion; when comparing that to today’s market cap of approximately $100 billion (with all time highs over $300 billions), analysts need to realize this is a much more legitimate and established asset class than 4 and 8 years ago. Although we may not see a 9336.36% increase like we did in the first halving, you can expect Bitcoin and the entire cryptocurrency ecosystem to react to this event.

Past Halving Events and their Effect on Bitcoin Price

Bitcoin’s market capitalization and the distributed ledger technology space as a whole has advanced substantially since the last halving in 2016, but we can still deconstruct past patterns of before and after the reward halvings to help us understand this one.

Although many analysts think the effect of the halving is already “baked in” to the price, this does not affect irrational or emotional buying patterns. Leading up to both halvings, the market was preparing by ‘accumulating’ Bitcoin. In anticipation of an inevitably lower future supply forecast, many users purchased Bitcoin hoping that the calculated ‘shock’ to the supply will result in a price increase. This collective mindset of accumulation was more evident in the 2016 halving when buyers drove the Bitcoin price up 13% in the month prior to the halving.

The First Bitcoin Halving

The first Bitcoin halving took place in November 2012 when the price of Bitcoin was fluctuating around $10-$12; within one year, the price rose to over $1000.00. The question we want to address is: did this direct impact on future Bitcoin scarcity cause this massive price increase? In the simplest terms, the answer is both yes and no; the Bitcoin halving has a large impact on how people view and use Bitcoin, but is not the only factor contributing to such a large increase in price.

The first Bitcoin halving had a large impact on how initial users viewed and used Bitcoin as a financial instrument, but is not the only factor contributing to such a large increase in price. In 2012, Bitcoin was still relatively obscure and definitely not trusted by everyone, almost no merchants or traditional financiers considered it as a legitimate tool of transferring value, so the volatility was much higher. When looking at the total market capitalization of Bitcoin at its first halving, substantially less fiat currency injected into the system was needed for it to grow, so the market cap shot up exceedingly fast with much less purchasing power.

As the first halving took place, the price of Bitcoin was $11 and the Bitcoin block reward swiftly decreased from 50 to 25 BTC. Over the next year, there was a historic rise in price, before a harsh 80% decrease thanks to the Mt. Gox exchange hack, the largest cryptocurrency hack at that time. Although the first halving cemented Bitcoin as a true deflationary currency, at that point in its history, the halving wasn’t the only contributing factor to the approximately 9000% price increase.

The Second Bitcoin Halving

What we will see in the third Bitcoin halving, will likely be more reminiscent of the second Bitcoin halving that took place in July of 2016. However, there are many different factors that differentiate the two situations. At the time of the second halving, we were seeing other cryptocurrencies like Ether push their way out of technological obscurity, as well as custodial services like Coinbase that made it infinitely easier for the average purchaser to get involved. On top of all the publications for Bitcoin, Ethereum, and multi-million dollar pizzas (the first ever Bitcoin transaction) that were now being reported on by the top outlets in the world, the total daily issuance of Bitcoin dropped from 3,600 to 1,800 BTC. The fact that the second halving happened to coincide with increased mainstream distribution of news focusing on the realities and future usability of blockchain, was an excellent catalyst to cause a price increase, as supply decreased and demand increased.

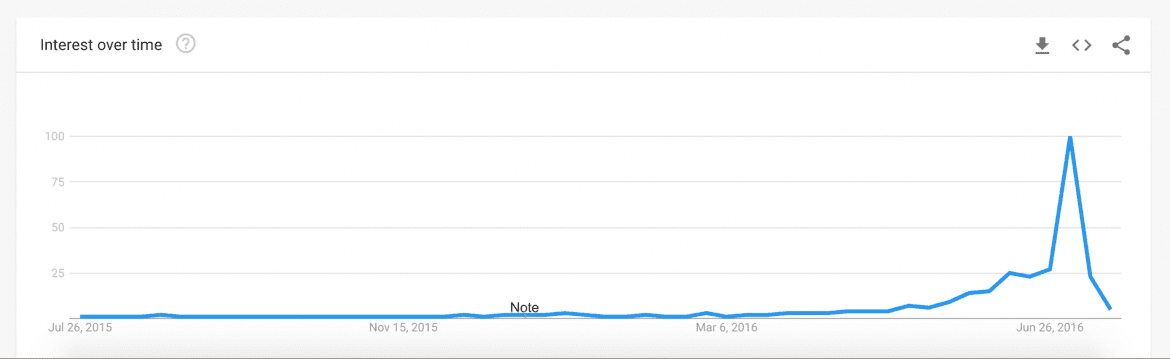

Although miners had some problems remaining profitable during the halving, we saw Bitcoin’s hashrate drop by over 10% from 1.56 EHash/s to l.4 EHash/s, it is clear more people showed interested in Bitcoin, the bitcoin halving, and how it will affect the future of the cryptocurrency leading up to the actual event. If you take a look at the Google Trends graph below for the search term “bitcoin halving” you can see the dramatic spike in the year long graph as the halving comes closer. This continued interested mixed with lower future supply had undoubted positive impacts on Bitcoin’s total market cap.

The Third Bitcoin Halving

Although the price of Bitcoin continues to be volatile following the 80% crash of 2017, it seemed to have bottomed out in late 2018 with relatively steady price increases and an optimistic future. The price had even re-breached $10,000, as Bitcoin continues to be easier to use and more well known to the masses. All of that changed in the short period of a few weeks, decimating the stock market, global trade capabilities, and the cryptocurrency market at once. Within less than one week, we saw Bitcoin’s price drop from over $9000 to $4,860, a 46% price decrease directly thanks to market uncertainty and falling global markets.

As the entire world buckles down and the global economy comes to an abrupt pause, we do not know how long global markets will be affected. We cannot fully predict what will happen in this year’s Bitcoin halving. Although Bitcoin’s price has since rebounded to over $6,600, it is hard to say what the immediate future of financial markets hold. Bitcoin’s daily issuance rate will continue to drop to only 900 BTC, but if financial markets are still in flux, we may not see it have the same effect that previous halvings had.

Bitcoin is more legitimate and usable than ever – you can now buy anything from gift cards to electronics with Bitcoin – which is evident in the 35% increase since the initial price drop following one of the biggest one-day point losses in stock market history. Users are confident in distributed ledger technology and will continue to buy and use Bitcoin, but with current global financial uncertainty and mining rewards dropping by a further 50% to already struggling miners, we will most likely see a decrease in hash rate that may not affect the price. In fact, if transactions become more expensive and slower following a decrease in miners, it may have an inverse effect on the immediate price. However, with continuous growing confidence in the Bitcoin ecosystem matched with continued scarcity through mining rewards, the price should undoubtedly reflect this scarcity and increase in the future.

Have past predictions about price fluctuations held up?

Three or four weeks ago (before the initial financial market meltdown), our opinions on how the Bitcoin halving would affect the future immediate price would have been different than they are now. Of course this is due to changing global factors, but this also points out that these are simply predictions, and things can change very suddenly.

Experts of every superlative qualification have made incorrect predictions, while novices sometimes predict correctly. When it comes to how the Bitcoin halving will affect future prices, this does not change, many of the top experts have predicted that Bitcoin should be worth 10s of thousands of dollars each at this point, and as we can see this is simply not true, no matter their historical background and AUM.

Not only has the Bitcoin halving price effect occurred several times, making the predictions grossly incorrect but the nature of predicting a market is in itself a work that sometimes more resembles divining than extrapolating concrete prognosis.

Possible future fluctuation factors to consider

There are a few possible factors that can impact Bitcoin’s price fluctuation in the future, the largest one currently being the global reaction and continuation of the global economy. Assuming everything returns to normalcy, government and financial regulators still always have the opportunity to drastically affect demand and usability. Another factor is mainstream usability, the easier it is to use and interact with others using Bitcoin, the more valuable each satoshi will become. As we continue to advance technologically, this usability will increase. We also need to consider major financial institutions and their reactions to Bitcoin’s usability; if they, one day, view it as a viable alternative to gold as a store of value or means of transfer, the impact can be bigger than any possible supply decrease.

Concluding thoughts

In conclusion, if the world wasn’t facing a possible impending financial collapse, we think the next Bitcoin price halving would have a net positive effect on the price and the ecosystem as a whole. As a reliable and deflationary currency, Bitcoin users can always count on Bitcoin to do exactly as it promises, regardless of its value. This level of transparency and usability is unparalleled, and as we continue to see an overall supply decrease with a steady and growing future demand, I only see one direction for the future of Bitcoin.

Latest Guides

What are Market Orders and How to Use Them?

What happens to Bitcoin’s price when it halves? When a market is affected by any factors the price will tumble, and most investors are in turn taking a loss. So what is happening when Bitcoin is suffering a halving price effect? With Bitcoin’s mining reward halving in the upcoming months, investors and analysts are curious […]

18 January, 2022A Comprehensive Guide To Reading Candlestick Charts Effectively

What happens to Bitcoin’s price when it halves? When a market is affected by any factors the price will tumble, and most investors are in turn taking a loss. So what is happening when Bitcoin is suffering a halving price effect? With Bitcoin’s mining reward halving in the upcoming months, investors and analysts are curious […]

5 January, 2022The Role of Fundamental Analysis

What happens to Bitcoin’s price when it halves? When a market is affected by any factors the price will tumble, and most investors are in turn taking a loss. So what is happening when Bitcoin is suffering a halving price effect? With Bitcoin’s mining reward halving in the upcoming months, investors and analysts are curious […]

29 December, 2021Key Drivers of the Crypto Market

What happens to Bitcoin’s price when it halves? When a market is affected by any factors the price will tumble, and most investors are in turn taking a loss. So what is happening when Bitcoin is suffering a halving price effect? With Bitcoin’s mining reward halving in the upcoming months, investors and analysts are curious […]

16 December, 2021How to Develop a Crypto Trading Plan?

What happens to Bitcoin’s price when it halves? When a market is affected by any factors the price will tumble, and most investors are in turn taking a loss. So what is happening when Bitcoin is suffering a halving price effect? With Bitcoin’s mining reward halving in the upcoming months, investors and analysts are curious […]

1 December, 2021Top 9 Crypto Exchanges by Volume in 2022

What happens to Bitcoin’s price when it halves? When a market is affected by any factors the price will tumble, and most investors are in turn taking a loss. So what is happening when Bitcoin is suffering a halving price effect? With Bitcoin’s mining reward halving in the upcoming months, investors and analysts are curious […]

11 November, 2021What is Staking in Crypto?

What happens to Bitcoin’s price when it halves? When a market is affected by any factors the price will tumble, and most investors are in turn taking a loss. So what is happening when Bitcoin is suffering a halving price effect? With Bitcoin’s mining reward halving in the upcoming months, investors and analysts are curious […]

4 November, 2021Which is the Fastest Cryptocurrency?

What happens to Bitcoin’s price when it halves? When a market is affected by any factors the price will tumble, and most investors are in turn taking a loss. So what is happening when Bitcoin is suffering a halving price effect? With Bitcoin’s mining reward halving in the upcoming months, investors and analysts are curious […]

25 October, 2021